Our Underwood Law Social Security Disability Lawyers are dedicated to helping YOU obtain the disability benefits you deserve.

If you are considering applying for Social Security Disability Insurance (SSDI) or Supplemental Security Income (SSI) or your case has been denied, we can take you through every step of the application or appeals process, from beginning to end. The best part is we can do it at no expense to you.

The Government hasn’t made obtaining SSDI or SSI benefits easy. There is endless paperwork to complete and complicated guidelines for determining whether or not you are eligible. Our qualified attorneys are specialists in Social Security Disability law and have a much greater chance to obtain the maximum benefits for you. If you have been denied, it’s even more important to have successful social security disability litigation attorneys on your side.

What Is Social Security Disability?

My Social Security disability claim was denied what do I do now?

How Does Social Security Determine Eligibility?

The Social Security Administration (SSA) has its own set of rules for determining disability. These rules are an endless source of confusion to medical providers who want to be helpful and great frustration for claimants who are denied and don’t understand why.

To be found disabled under Social Security or SSI standards, we must prove that our clients are unable to do any kind of full-time work at all – even the lightest type of work. Most other disability insurance programs require only a showing that a person is unable to return to former work.

SSA calls its standards for disability the “Listing of Impairments.” It is a part of the Code of Federal Regulations, a publication about 70 pages in length.’ In this relatively short document, disability standards are set out for most physical and mental disorders.

The “Listings,” as they are known, are fairly comprehensive. Rare conditions are more difficult to prove, but most disabled people can fit somewhere into the Listings, and in fact may fit into more than one if there is a combination of impairments.

At the third step in the process, Social Security takes a look at whether a person “meets” the Listing of Impairments. Does the diagnosis and list of symptoms match those shown anywhere in the Listings? Do the clinical observations and lab findings support the claim adequately? If so, the claimant may win the case and no further evidence is needed. If not, the decision making process goes forward to an evaluation of whether there is any kind of work the person can perform.

Late in 2008, Social Security established a list of about 30 conditions which qualify for immediate “compassionate allowances.” These illnesses are so grave that they invariably result in an allowance. The list includes some leukemias and cancers, and Lou Gehrig’s disease. The full list can be viewed at http://www.socialsecu-rity.gov/compassionateallowances/conditions.htm.

The most valuable contribution we make to a case is our experience, which encompasses knowing exactly what Social Security needs to allow a claimant to win. We work closely with medical providers to get precisely the right information. We ask treating sources the right questions, and so we get the answers in terminology the Administration will recognize.

Because Social Security’s standards are unique, a simple statement that “this patient is disabled and cannot work” is of little value. Precise information is needed, and we will elicit and submit it with our arguments, showing why claimants should be found disabled under the law.

How Can a Claimant Afford a Lawyer?

Virtually all Social Security and SSI disability claimants are unemployed. Because of this, many claimants (and those trying to help them) believe that they cannot afford appropriate legal help. It’s a common misconception to think that a lawyer’s help is not an option.

It would be ideal if these applications and appeals were simple enough to do alone. The new all-electronic records implemented this year by Social Security has actually made things more complicated. Getting things into the right place in electronic files is a new hurdle.

Our Underwood offices will assist with the paperwork that often overwhelms a disabled claimant. We will obtain the necessary medical reports and records, and submit them to the right office.

We have been working in this area of law for many years. We know the people and the rules and laws.

We will work with you to form a winning strategy. We may also be able to obtain a larger back benefit for a claimant by re-opening a prior claim.

But how can a claimant, who is disabled and usually in financial distress, afford to hire a lawyer? We represent claimants on a contingency fee basis. The fee – 25% of the back benefit obtained for the claimant is set by federal regulation and must be approved by Social Security. The claimant does not have to pay unless and until the case is won and there is a recovery of benefits. Congress also sets a $6000 maximum on the fee for work done, up to and including a hearing.

If the claimant is indigent and unable to pay for medical records, we will get those records, deferring

repayment until the claimant receives benefits or other arrangements are made to repay the costs. Anyone can have an attorney for a Social Security or SSI claim. In our practice, we provide a free initial consultation and will review a case at no charge.

What is 551? What is SSDI?

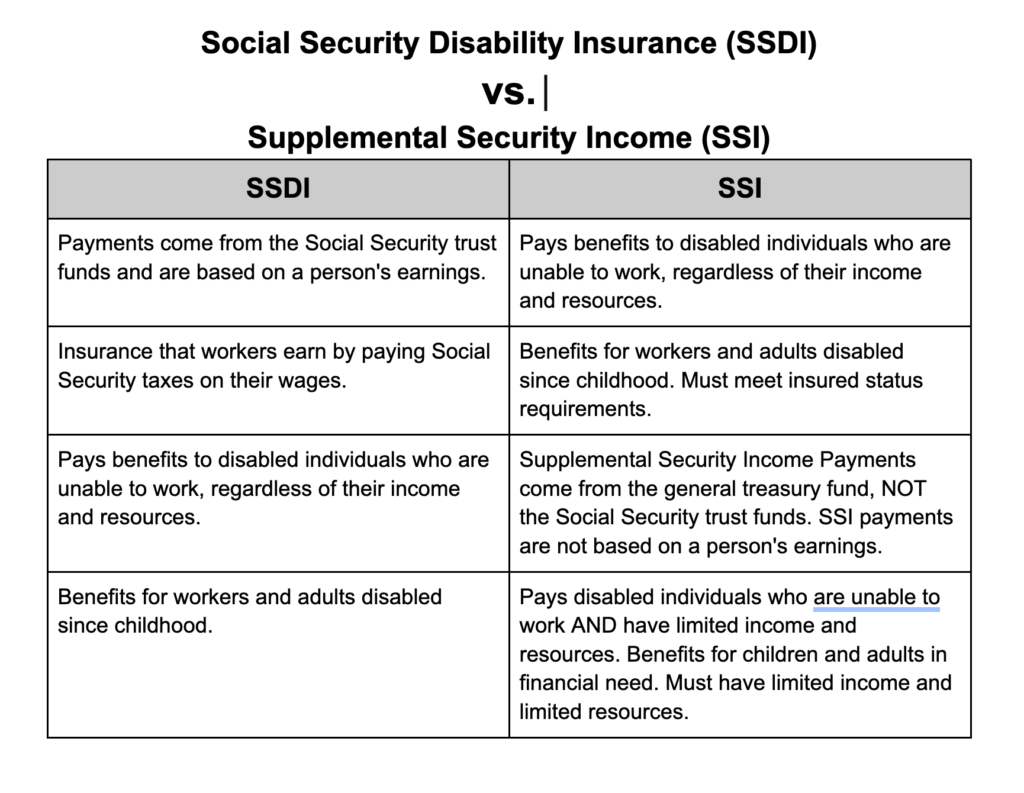

Social Security has two programs that pay disabled people. One is SSI (Supplemental Security Income); the other is “regular” Social Security, or SSDI. There is a lot of confusion about these two programs in the mind of the public. The difference is simple.

The SSDI or “regular” disability program pays a claimant based on the money paid into Social Security during a lifetime. The amount is determined by how much has been paid in, divided by years of life expectancy. Payments may also be sent to a spouse and children. Eligibility includes Medicare two years after entitlement date.

The SSI program is an entitlement program, paid to people who had no work record during the past five years. There is an asset limitation and a household income limitation for eligibility as well. There is immediate state Medicaid coverage with this program.

Success Rates on Claims

In our area, about 73% of initial applications were denied. Two-thirds of those who appeal those denials eventually win their cases.

While they wait the 2-3 years that an appeal takes, many have had to declare bankruptcy, some even died while awaiting hearings. After that initial denial, many become discouraged and drop out of the process.

Claimants need to take the appeal to the next level, called “Reconsideration,” and be prepared to be denied again, because around 90% of claimants are denied at this level. Hearing requests are filed after the denial of the “Reconsideration” request. The Huntington office has an appalling 320 day wait for hearings, and a request for hearing is filed only after being denied twice. People need help getting the right decision the first time, and that’s where we come in. We find the

greatest success rate at the hearing level. The national statistics are that 62% of claims are granted at the hearing level. For claimants with attorney representation, the success rate is much higher, up to 90% favorably concluded.

Claimants need to be carefully monitored to make sure the necessary appeals are filed within 60 days of denial. A claim that has to be re-filed rather than appealed could result in substantial loss of back benefit payments.

Unemployment Benefits and Disability Law

There is a quandary in applying for federal Social Security disability benefits while also signing up for state unemployment insurance. On the one hand, a Social Security disability applicant, to be eligible, is claiming that any kind of work is impossible. On the other hand, asking for unemployment insurance means swearing that the applicant is “available, willing and able” to work. Often, continuing proof of job searches must be provided for unemployment to continue.

This sticky situation is usually not considered at the first levels of application for Social Security benefits. But when a case arrives at the hearing, issues of credibility may arise. While receipt of unemployment benefits is not an automatic bar to disability benefits, it is a delicate matter to present to a judge. Technically, a claim cannot be denied solely on this basis. But there can be challenging moments if a claimant is directly asked a question such as: “were you lying then or are you lying now?”

Questions to be addressed include whether the application for unemployment benefits took place at a time when the applicant thought he could work. Explore the history of the unemployment application:

Was the claimant ever actually offered work? Were there work attempts that failed? A claimant may have truly believed that he could work when he applied for unemployment. A medical condition may have deteriorated since, or the marketplace may have demonstrated that the claimant is not employable. A desire to work is not determinative of ability to work.

The reality is that state unemployment benefits are processed and paid much more quickly than Social Security benefits. Most federal courts hold that application for unemployment is “some” evidence, but not “conclusive” evidence of ability to work, and of credibility.

Social Security often says it is “never bound by the determination of another agency.” The Social Security Administration has devised its own precise standards for disability, and they are decidedly not the same as those of the state unemployment program. There is no medical assessment of work-readiness required to apply for unemployment. Treating physicians may even be advising against work.

SSDI vs SSI